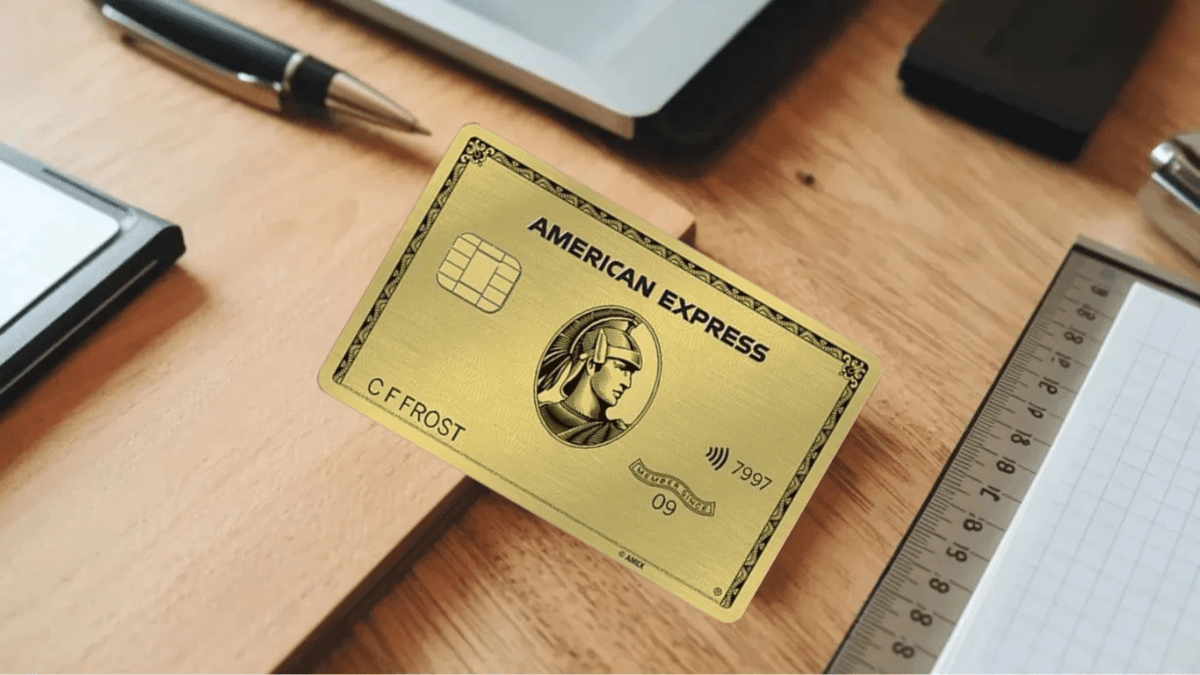

Amex Green: Explore the American Express® Green Card—earn 3X Membership Rewards® points on travel, transit, and worldwide dining. Enjoy perks like a $199 CLEAR® Plus credit, no foreign transaction fees, and flexible payment options with no preset spending limit. Learn about annual fees, eligibility, and how the Amex Green Card makes travel and everyday spending more rewarding for practical adventurers and food lovers alike

#American Express Green Card: A Friendly Guide for Travelers and Everyday Spenders

The American Express® Green Card is a classic that’s been updated for the modern traveler and anyone who wants to earn rewards on dining, travel, and daily commutes. If you’re curious about what makes the Amex Green Card special, here’s a simple, human-friendly overview.

Generous Rewards on What Matters Most

- 3X Points on Travel:

Earn 3 Membership Rewards® points per dollar on a wide range of travel purchases—including flights, hotels, cruises, car rentals, vacation rentals, and even campgrounds. This also covers transit like trains, rideshares, buses, ferries, tolls, and parking. - 3X Points at Restaurants:

Whether you’re dining out, grabbing takeout, or ordering delivery in the U.S., you’ll earn 3X points at restaurants worldwide. - 1X Points on Everything Else:

All other eligible purchases earn 1 point per dollar, so you’re always collecting rewards.

Valuable Welcome Bonus

- Big Intro Offer:

New cardholders can earn 40,000 Membership Rewards® points after spending $3,000 in the first 6 months. Depending on how you redeem them—especially with airline and hotel partners—this bonus can be worth $800 or more.

Travel Perks and Credits

- CLEAR® Plus Credit:

Get up to $199 in annual statement credits for CLEAR Plus membership, which helps you breeze through airport security using biometrics - Lounge Access Credit:

Receive up to $100 per year in statement credits for

airport lounge passes purchased through LoungeBuddy,

making your travel more comfortable - No Foreign Transaction Fees:

Use your card abroad without worrying about extra charges,

making it a great companion for international trips.

Travel and Purchase Protections

Trip Delay Insurance:

If your round-trip is delayed by more than 12 hours for a covered reason,

you can be reimbursed up to $300

per trip for extra expenses, up to twice per year

Baggage Insurance:

Coverage for lost, damaged, or stolen luggage

when you pay for your trip with the card.

Purchase Protection:

Eligible new purchases are covered against damage or theft for up to 90 days,

up to $1,000 per item and $50,000 per year.

Flexible Payment Options

No Preset Spending Limit:

The Green Card adapts to your spending habits,

so you’re not limited by a fixed credit line.

Pay Over Time:

You can choose to pay your balance in full

each month or carry a balance with interest,

offering flexibility for big purchases.

Annual Fee

- The American Express Green Card has a $150 annual fee, which is relatively modest considering the travel credits and rewards you can earn.

Who Should Consider the Amex Green Card?

- Frequent travelers who want to earn rewards on flights, hotels, and transit

- Foodies who love dining out or ordering in

- Anyone who values travel perks like expedited airport security and lounge access

- People seeking flexible rewards that can be transferred to travel partners

Bottom Line

The American Express Green Card is a well-rounded choice for

those who want to maximize points on travel and dining without paying a

sky-high annual fee. With valuable credits, strong protections,

and flexible rewards, it’s a smart pick for both adventure seekers and everyday spenders